The world is going digital and everything will be done at light speed. To accommodate transactions in a digital world we need to create a currency that can keep up and be accurate at the same time. The new wave of cryptocurrencies is poised to replace traditional FIAT currencies as we move towards this brave new digital world.

Cryptocurrencies are digital assets that use complex cryptographic hash functions on a distributed computer network to validate and secure transactions between peers in a peer-to-peer (P2P) network. These digital assets use blockchain, which is a type of distributed ledger, to record all transactions.

Blockchain is a distributed ledger that immutably links transactions together using strong cryptography. Each transaction made on the network will be recorded and added to a block that is governed by a strict set of cryptographic rules. Blocks are linked to other blocks using strong cryptography forming a chain, also known as, a blockchain. Since there is strong cryptography tying these blocks together, it is nearly impossible to alter a single transaction within the chain, as this will have an impact on all the other blocks in the chain, which could be millions of blocks of transactions.

Taxes on Cryptocurrencies

For the purpose of tax, cryptocurrencies are considered assets or property. The tax to be levied on them depends on the purpose they were used for and the duration for which they were held before transacting. Let’s take a closer look at the various scenarios that create a taxable event in the case of cryptocurrencies and how to file crypto tax.

Investments made in Cryptocurrencies

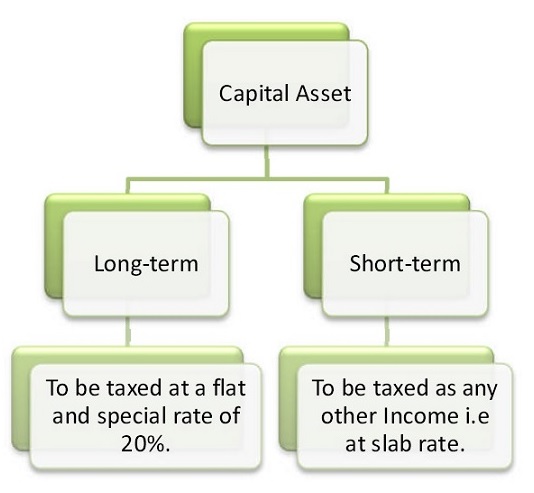

If you have bought cryptocurrencies as an investment, the period for which you held them will determine your tax liability.

Long-Term Capital Assets

These types of assets are assets that have been held for a period of longer than 1 year. If you hold a crypto currency for a period longer than 1 year and decide to transact with it, any profits or gains from such transactions will be considered as long-term capital gains. These gains are taxed at 0%, 15%, and 20% depending on the income.

Short-Term Capital Assets

These types of assets are assets that are held for a period shorter than 1 year. Any profits or gains from transacting in crypto currencies held for a period of less than 1 year should be included in your gross income and will be taxed in accordance with your Federal Income Tax slab.

Crypto-Mining

Crypto-mining is the process of contributing your computing power to regulate and assist in verification of transactions within the network. When a computer completes a number of cryptographic hash functions to verify a transaction it is rewarded a unit of the crypto currency network it participating in. If you participate in crypto-mining you will need to pay taxes on every unit of crypto currency generated, for this, you will need to record the US Dollar value of the unit at the time you received it.

Payments for Goods or Services Received in Crypto currencies

There are a number of businesses that pay their vendors in crypto currencies these days. If you have received payment for any goods are services rendered by you, you will need to record the US Dollar value of the crypto currency at the time you received it. This is due to the fact that it will be included in your gross income for tax purposes and will be taxed according to your Federal Tax Bracket.

Salaries Paid to Employees

If you are an employer that pays your employees’ salary through crypto currency, you will need to record the US Dollar value of the crypto currencies at the time your employees received it and these details will need to be furnished when you are filling out W-2 Forms.

Software that can Help Out

Manually recording the US Dollar value of each cryptocurrency transaction is a very time-consuming task, and you could make mistakes, leading to penalties and fines or even worse, jail time. For this reason, there are a number of software packages developed around cryptocurrency. These platforms can help you do everything from monitoring your crypto-wallets to monitoring crypto-markets in real-time and they can even help you file your crypto-taxes. Let’s take a look at our picks for the 3 best crypto tax software packages that can make filing crypto-taxes an absolute breeze.

TokenTax

TokenTax is a powerful crypto-tax calculator. This platform is linked to all the top crypto-exchanges and allows you to connect your crypto-wallet directly. This lets users import all their wallet transactions to TokenTax at the click of a button. Once you feed all your data into the software it will generate all the necessary tax forms like 8949, TurboTax, FBAR, FATCA, and other important reports that you might need.

ZenLedger

ZenLedger is one of the most advanced crypto-tax calculators on the market today. The platform allows you to connect your crypto-wallets and import all your crypto-transactions from major exchanges into the calculator within seconds. Other than generating all the necessary forms for filing crypto-taxes it also monitors your crypto-transactions, tracks the crypto-market and provides you a real-time valuation of your cryptocurrencies, prepares additional reports like capital gains reports, donation reports, income reports, and closing reports.

BearTax

BearTax is a lightweight crypto-tax calculator that has one of the cleanest user interfaces on the market. You can use the platform to import transactions for 25 top crypto exchanges and the software will calculate your gains and will provide you downloadable reports to file along with your taxes. If you are using an exchange that is not linked to BearTax, you can simply import your transactions in a .CSV format document.

So the next time the taxman comes knocking make sure you have all your reports ready to be filed using these software packages to stay on top of all the paperwork.